International Data Corporation (IDC) Forecasts Significant Growth in Quantum Computing Market

According to a new report published by the International Data Corporation (IDC), the worldwide quantum computing market is projected to experience substantial growth in the coming years. The report predicts that customer spend for quantum computing will increase from $1.1 billion in 2022 to $7.6 billion in 2027, representing a five-year compound annual growth rate (CAGR) of 48.1%. This forecast includes both base quantum computing as a service and enabling and adjacent quantum computing as a service.

The latest forecast is lower than IDC's previous quantum computing forecast, which was published in 2021. Several factors have negatively impacted customer spend for quantum computing, including slower than expected advances in quantum hardware development, the emergence of other technologies such as generative AI, and various macroeconomic factors. IDC expects the market to continue experiencing slower growth until a major quantum hardware development that leads to a quantum advantage is announced. In the meantime, growth will primarily be driven by maturation in quantum computing infrastructure and platforms, as well as the growth of performance-intensive computing workloads suitable for quantum technology.

Investments in the quantum computing market are also expected to grow at a CAGR of 11.5% over the 2023-2027 forecast period, reaching nearly $16.4 billion by the end of 2027. These investments will come from public and privately funded institutions, technology and services vendors, venture capitalists, and private equity firms. Notably, global government agencies have shown increasing interest in quantum computing, with 14 countries and the European Union announcing quantum initiatives that will generate billions of dollars for research.

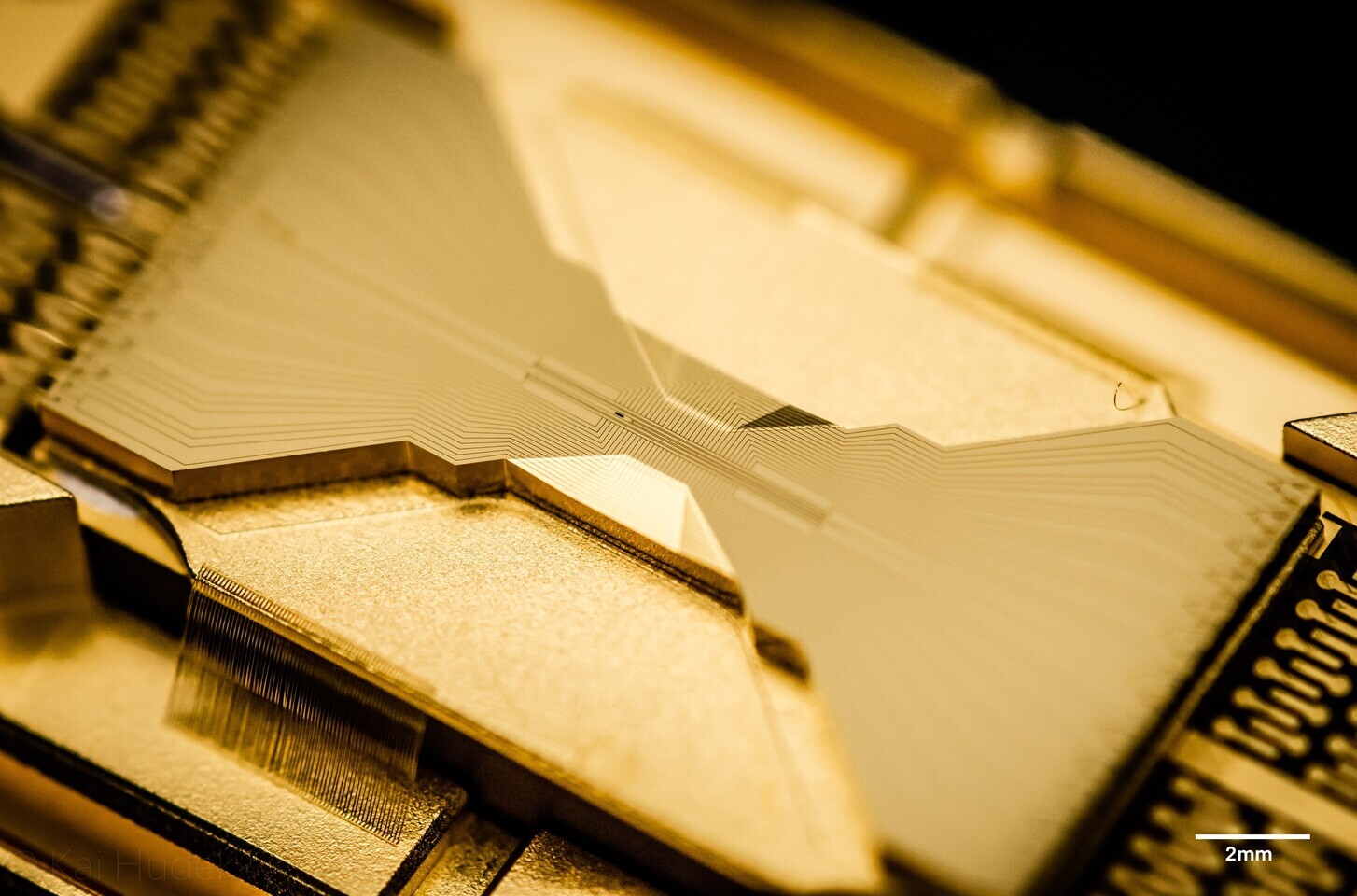

The significant investments in research and development have led to advancements in quantum computing hardware and software, as well as new error mitigation and suppression techniques. These advancements have fueled speculation that achieving a near-term quantum advantage may be possible using today's noisy intermediate-scale quantum (NISQ) systems. In the long term, these investments are expected to result in the development of large-scale quantum systems capable of solving complex problems, leading to a surge in customer spend towards the end of the forecast period.

2022 is expected to be a pivotal year in the quantum computing industry. Vendors have implemented strategic approaches to reach a near-term quantum advantage using NISQ systems, focusing on improving qubit scaling and developing new techniques for error mitigation and suppression. Accessibility and usability of quantum systems have also improved, with previously inaccessible quantum modalities becoming available for end-user experimentation. Additionally, partnerships for on-premises quantum deployments have been announced, and frictionless software offerings for nonquantum specialists have been introduced. Furthermore, the anticipated launch of new scientific accelerator platforms will facilitate the integration of quantum, AI, and HPC.

"There has been much hype around quantum computing and when quantum computing will be able to deliver a quantum advantage, for which use cases, and when," said Heather West, Ph.D., research manager within IDC's Enterprise Infrastructure Practice. "Today's quantum computing systems may only be suitable for small-scale experimentation, but advances continue to be made like a drumbeat over time. Organizations should not be deterred from investing in quantum initiatives now to be quantum ready in the future."

The IDC report, titled "IDC's Worldwide Quantum Computing Forecast: 2023-2027: Surfing the Next Wave of Quantum Innovation" (IDC #US49198322), provides a comprehensive market forecast for customer spend on quantum computing (hardware, software, cloud, and other services) from 2023 to 2027. The report includes a breakdown of base quantum computing as a service, as well as enabling and adjacent quantum computing as a service. It also offers an overview of the market, including trends in quantum computing investments, and examines the drivers and challenges faced by quantum computing vendors and cloud service providers.